Principles of governance

Governance is at the heart of corporate responsibility and overall performance. The Orabank Group has a clear, transparent and effective governance structure. Our directors are loyal and can attest to their good repute at any time. These are evaluated annually according to an internal model (self-assessment) or an external model (by an external provider).

10

Administrators

1

Female Administrator

4

Independent Administrators

95%

Attendance at Board meetings

5

Board Committees

Board of Directors

Oragroup is supervised by a Board of Directors, including 4 seats allocated to independent members. All Oragroup subsidiary banks have a Board of Directors. The Boards shall have a balanced composition between independent and executive directors and shall meet several times each financial year. As of December 31, 2022, the Board of Directors includes 10 directors, including one woman and four independents members:

Names and forenames | Administrator Quality | Term renewal date |

|---|---|---|

Vincent LE GUENNOU | Non-Executive, President of the Council | AGO 29 June 2020 |

Ibrahima DIOUF | Non-Executive, Permanent Representative | AGO 29 June 2020 |

Brice LODUGNON | Non-Executive, Permanent Representative | AGO 29 June 2020 |

Ferdinand NGON KEMOUM | Executive, CEO | AGO 29 June 2020 |

Alassane BA | Non-Executive, Independent | AGO 29 June 2020 |

Marie Ange SARAKA YAO | Non-executive, Independent | AGO 29 June 2020 |

François KLITTING | Non-Executive, Independent | AGO 29 June 2020 |

Tchétché N’GUESSAN | Non-Executive, Independent | AGO 29 June 2020 |

William NKONTCHOU | Non-Executive | AGO 29 June 2020 |

Jean-Louis MATTEI | Non-Executive | AGO 29 June 2020 |

Presidency

Mr. Vincent Le Guennou, appointed in 2009, is Chairman of the Board of Directors.

Appointment of members

The role of the Risk Committee is to assist the Board of Directors in overseeing the implementation of the risk management framework.

For example, the Risk Committee:

- Ensures that the integrated risk management framework meets regulatory requirements and functions properly

- Has a good understanding of the nature and extent of the risks involved, the interrelationships between these different risks and the levels of capital and liquidity required to cover these exposures;

- Submits proposals to the Board for approval on the level of appetite for current and future Group-wide risk and the limits on, inter alia, credit, investment and concentration;

- Periodically reviews risk policies and procedures in light of changes in business operations and ensures that they are aligned with the risk strategies and risk appetite approved by the Board;

- Ensure that the executive body takes the necessary measures to control and control all significant risks in accordance with approved risk appetite strategies and levels.

The Risk Committee met seven times during 2022, including 2 joint meetings with the Audit Committee. Meetings are held on 10 January, 25 February, 13 April, 17 June, 05 September and 16 September and 15 November. Attendance rate of membership was 100%.

In accordance with its mandate, the Committee took note of the periodic reports submitted by the Risk Management and the Credit Department, the Recovery Department, the Legal Department and the BMB entity and ensured throughout the financial year 2022 the independence of the risk management function.

Names and forenames | Administrator Quality | Membership of the Committees | Expertise |

|---|---|---|---|

Vincent LE GUENNOU | Non-Executive, President of the Council | CEO of Africa50 Infrastructure Acceleration Fund | |

Ibrahima DIOUF | Non-Executive, Permanent Representative | Audit Committee Observer, Member of the Risk Committee and the Human Resources and Compensation Committee | BOAD’ President Special Adviser, with over 30 years of experience in the African and international banking sector. Audit, Governance, and Bank Financing Specialist |

Brice LODUGNON | Non-Executive, Permanent Representative | Chairman of the Audit Committee and member of the Human Resources and Compensation Committee | More than 20 years of experience in private equity in Africa |

Ferdinand NGON KEMOUM | Executive, CEO | Previously, Managing Director at Framlington Asset Management and several senior positions at LOITA Capital Partners International | |

Alassane BA | Non-Executive, Independent | Member of the Investment and Strategy Committee | Senior investment banker with 30 years of experience in banking, infrastructure finance and real estate |

Marie Ange SARAKA YAO | Non-executive, Independent | Member of the Risk Committee and the HumanResources and Compensation Committee | Managing Director of GAVI’s Department of Resource Mobilization and Private Sector Partnerships. 20 years of strong experience in strategic leadership, policy development, financial innovation and resource mobilization in emerging and global markets |

François KLITTING | Non-Executive, Independent | Chairman of the Risk Committee and member of the Ethics, Good Governance and Nomination Committee | Mercialys’ General Secretary, specialized in commercial real estate. Previously, several key positions including Director of Financial Activities of Crédit d’Equipement des PME, Financial Director of AXA Investment managers or Director of Investments of AXA France |

Tchétché N’GUESSAN | Non-Executive, Independent | Chairman of the Ethics, Good Governance and Nomination Committee and member of the Audit Committee | Doctor of Economic Policies, Full Associate Professor of Universities in Economic Sciences and Honorary Director of the Ivorian Center for Economic and Social Research |

William NKONTCHOU | Non-Executive | Member of the Ethics, Good Governance and Nominating Committee and the Investment and Strategy Committee | President and co-founder of AFIIP, formerly Chief Executive Officer of ECP |

Jean-Louis MATTEI | Non-Executive | Chairman Investment and Strategy Committee and observer of Audit and Risk Committees | More than 30 years of experience in leading banking institutions |

Sylvie MAHOU-LO | Group Audit Director | Non-Audit Committee Secretary | More than 20 years of experience in audit, control, risk, control and financial advice |

Assiba Ponou KOUASSI | Group Risk Director | Non-member Secretary of the Risk Committee | More than 20 years of experience in risk control |

Guy TANKPINOU DOTOU | Director of Legal and Litigation | Non-member Secretary of the Ethics, Good Governance and Nomination Committee | Strong experience in management and legal and tax advice |

Serge MIAN | Director of Investor Relations | Non-member Secretary of the Investment and Strategy Committee | Strong experience in advising on risks and financial investments, committed to the sustainable development of an emerging Africa |

Katala LOUA | Director of Human Capital | Non-member Secretary, Human Resources and Compensation Committee | 15 years of experience in senior positions in the HR function |

Ethical Governance

The Board of Directors ensures that it has at least 1/4 independent directors, as recommended in Circular No. 01-2017/CB/C on the Governance of WAMU Credit Institutions and Financial Companies. An Executive Director shall be independent when he or she has no relationship of any kind with the institution or its group that would impair his or her independence of judgment or place him or her in a situation of apparent or potential conflict of interest.

At its meeting of 25 April 2023, the Board of Directors, on a proposal from the Ethics, Good Governance and Nomination Committee, reviewed and confirmed the independence of the four directors appointed in this capacity to the Board. On a proposal from the Committee, the Board considered, in accordance with Circular No. 01-2017/CB/C on the Governance of WAMU Credit Institutions and Financial Companies, that an administrator is independent if he or she meets all nine independence criteria mentioned in Article 11 of the Circular. Accordingly, the Board held on April 25, 2023, based on the Ethics Committee for Good Governance and Nomination report of April 19, 2023, confirmed the independence of directors Tcheche N’GUESSAN, François KLITTING, Alassane BA, and Marie-Ange SARAKA YAO.

The Directors shall behave fairly towards the company. They be courageous, transparent, honest, and discerning. They must always be able to prove that they are of good repute for the performance of their duties. They must be available and actively involved in carrying out the tasks and duties entrusted to them.

An Ethics and Good Governance Committee has been set up which collects and deals with all matters relating to ethics, deontology and governance. It is one of the most active committees of the Orabank Group Board of Directors, which in 2015 adopted a Charter of Governance applicable to all staff and managers of the Group and a Rules of Procedure of the Board of Directors.

In addition to the rules of operation of the Board of Directors laid down in the Company’s articles of association, the Board has adopted rules of procedure which define the rights and duties of the Directors and specify the operating procedures of the Board and its specialized committees in accordance with the articles of association, and a charter of the director.

Tasks of the Board of Directors

The Board of Directors shall determine the guidelines for the Company’s activities and shall ensure that they are implemented. Subject to the powers expressly conferred on shareholders’ meetings and within the limits of the objects of the company, it shall take up any matter concerning the good operation of the Company and shall, by its deliberations, settle the matters concerning it. The Board of Directors is vested with specific powers by law, the statutes, and its rules of procedure.

Thus, the Board of Directors has the following functions, among others:

- Define and endorse the Corporation’s overall strategy, corporate governance framework, corporate culture, principles, and values.

- Assume ultimate responsibility for the financial soundness of the Company and its compliance with the legal and regulatory provisions governing its activities.

- Engage effectively in activities of the Company, in accordance with its legal, regulatory and statutory responsibilities, by being aware of significant changes arising from the economic or operational environment of the Company and by acting in a timely manner to protect the long-term interests of the Company.

The Board sets the schedule of its meetings at the beginning of the year, following a frequency of one meeting per quarter except for urgent or necessary meetings. The Board shall be convened by letter sent to its members at least eleven days in advance. Prior to each meeting, the Company shall provide the members of the Board with the information necessary and useful to decide on the agenda, including qualitative and quantitative information on the activities of the Company and the Group.

The Board shall discuss its composition, organization, functioning and evaluate its work at least once a year. The minutes of each meeting shall be expressly approved at the next meeting.

In 2022, the Council met eight times, on 8 February, 25 April, 27 June, 7 July, 9 August, 20 September, 25 November, and 20 December. The meetings were held in person and by videoconference with at least three administrators on the same site, including the executive management.

The average duration of the meetings was 3 hours and remained stable compared to the previous year.

In addition, the average attendance rate of directors at meetings was 95% ahead of the previous year.

At each meeting of the Board of Directors, an update is given to date on the Group’s activities and results on the funding established or renewed during the financial year.

Oragroup’s activities during 2022 took place in the orthodoxy of good governance. Oragroup’s decision-making bodies, particularly the Board of Directors and its committees, have met regularly with constant concern to improve the governance undertaken in previous years. Under the overall supervision of the Audit Committee, the second and third-level controls covered all the institution’s activities and services with satisfactory results in terms of risk control. They provide reasonable assurance on the effectiveness and efficiency of operations, the reliability of financial information, and compliance with laws and regulations.

In 2023, Oragroup will continue to strengthen its governance in the context of the implementation of the new instructions and circulars of the Banking Commission that came into force in 2021 and to strengthen the capacity of its staff to maintain a high level of service to customers, in an ongoing concern to control risks and preserve the quality of its signature.

Specialized Committees

In accordance with the provisions of the statutes and the law, the Board has set up, in the spirit of good corporate governance, five specialized committees, namely:

- The Audit Committee,

- The Risk Committee,

- The Ethics Committee, Good Governance and Appointment,

- The Investment and Strategy Committee,

- The Human Resources and Compensation Committee.

Each of these committees has a charter which defines its role and tasks. The functions and operating rules of each of these committees are laid down in their charters which have been validated and adopted by the Board. These charters have also been brought into line with the provisions of Circular No. 01-2017/CB/C on the governance of credit institutions and financial companies.

Meetings of these committees shall take place in sufficient time before the Board of Directors is held. These committees report regularly to the Board on their tasks and report on their recommendations.

Committee assessments are done online in a digitized way. In the light of the results of the evaluations received, the functioning of the committees appears satisfactory in each of the areas evaluated. The points for improvement to all committees are the deadlines for transmitting of documents to members.

The Audit Committee role is to assist the Board in carrying out its supervisory and control function, which shall include:

- Supervision of the bank’s internal control framework;

- The approval of the short- and medium-term audit plan and the subsequent budget;

- Review of all reports or summaries produced by the Audit function;

- Review of financial reporting;

- Review of the mission plan, reports and recommendations of the external auditors;

- Monitoring the implementation of the recommendations made in the reports of the internal and external auditors;

- The examination of the individual and consolidated annual accounts and their reliability as well as the relevance of the financial information produced;

- The opinion given on the choice of the Group’s and subsidiaries’ auditors, this choice being validated by the Group’s or subsidiary’s Board of Directors, where applicable;

- The appointment, transfer or dismissal of the head of the internal audit function and of the internal auditors.

In 2022, the Audit Committee met five times, on 18 March, 13 April, 20 July, 08 September and 15 November. The attendance rate of its members was 100%.

The role of the Risk Committee is to assist the Board of Directors in overseeing the implementation of the risk management framework.

For example, the Risk Committee:

- Ensures that the integrated risk management framework meets regulatory requirements and functions properly

- Has a good understanding of the nature and extent of the risks involved, the interrelationships between these different risks and the levels of capital and liquidity required to cover these exposures;

- Submits proposals to the Board for approval on the level of appetite for current and future Group-wide risk and the limits on, inter alia, credit, investment and concentration;

- Periodically reviews risk policies and procedures in light of changes in business operations and ensures that they are aligned with the risk strategies and risk appetite approved by the Board;

- Ensure that the executive body takes the necessary measures to control and control all significant risks in accordance with approved risk appetite strategies and levels.

The Risk Committee met seven times during 2022, including 2 joint meetings with the Audit Committee. Meetings are held on 10 January, 25 February, 13 April, 17 June, 05 September and 16 September and 15 November. Attendance rate of membership was 100%.

In accordance with its mandate, the Committee took note of the periodic reports submitted by the Risk Management and the Credit Department, the Recovery Department, the Legal Department and the BMB entity and ensured throughout the financial year 2022 the independence of the risk management function.

The role of the Ethics, Good Governance and Nomination Committee is to assist the Board for better governance within the Orabank Group and in particular to:

- Support the Board in the development of governance based on the principles of effectiveness, transparency and accountability;

- Propose to the Board the adoption of new governance practices, codes of conduct, and evaluate existing ones;

- Overseeing governance, sustainable development and social responsibility;

- Advise the President of the Board on matters of deontology and ethics and assist him on the application and interpretation of the Ethics and deontology code to members of the Board, social and staff;

- Select new directors and appoint members of the executive body;

- Assess the effectiveness of the Board of Directors; Identify potential independent directors to select;

- Continuously ensure that established procedures are transparent and respected;

- Provide advice and recommendations to the legislative body on the institution’s human resources policy.

In 2022, the Ethics, Good Governance and Nomination Committee met four times in the presence of the invited General management, on 1 February, 19 April, 19 July and 18 November. The attendance rate of the members was 100% and the average duration of a meeting, 2 hours.

The main topics discussed during the sessions focused on governance, ethics, the annual update of the Group’s governance charter, the recruitment of independent directors in subsidiaries, the validation of BSA’s conversion requests, Oragroup’s capital increase, the evaluation of the Board, its members and specialized committees, the training schedule for directors, and the rotation of members of specialized committees.

The role of the Investment and Strategy Committee is to assist the Board of Directors in the following areas:

- To support the Group’s development projects by providing a framework for the internal and external growth operations that the Group may undertake through the creation of new subsidiaries or the acquisition of existing companies and by providing a framework for any other investment undertaken by the Group;

- Define and revise, as necessary, the Group’s investment strategy, which combines both investment policy and investment criteria, and ensure compliance with applicable regulations, rules of conduct and investment guidelines. The CIS is responsible for overseeing the implementation of this investment strategy;

- Propose to the Board of Directors the Group’s strategic guidelines and business model by evaluating its strategic position, considering the evolution of its environment and its markets as well as the medium and long-term development axes.

The Investment and Strategy Committee met three times in 2022, on April 20, September 16, and November 17. The attendance rate of the members was 77%.

The main topics covered during this year’s sessions are financial, namely, fundraising, strengthening the entities’ capital base, the Group’s treasury plan, Oragroup’s financing plan, Oragroup’s strategy, the start-up of SGI’s activities, the subsidiary turnover plan, the partnership and external growth project.

In fulfilling its role of assisting the Board of Directors, the Human Resources and Compensation Committee shall have the following functions and responsibilities:

- Assist the Board in the recruitment process for Holding Directors;

- Propose, where necessary, amendments to the procedures for the recruitment of holding managers;

- Ensure that the recruitment process for Holding managers is organized in a rigorous, objective, professional and transparent manner;

- Ensure that established procedures are transparent and followed;

- Identify, address or even eliminate situations of conflict of interest that could arise from the process of recruitment of Holding Directors in order to ensure their objectivity;

- Propose to the Board of Directors the elements of their remuneration submitted to the General Assembly Meeting.

- Propose to the Board the remuneration elements of the executive management (Group and subsidiaries Managing directors, Group and subsidiaries Deputy Managing directors and Holding Directors), that will be submitted to the General Assembly;

- Supervise the development and implementation of the remuneration system of the holding company and the Group;

- Ensure that this system is appropriate and consistent with the culture and risk appetite of the holding company, its long-term activities, its long-term risk management strategy, its performance and its internal control system;

- Ensure that this system complies with all legal and regulatory requirements;

- Review, analyze and monitor, at least once a year, the plans, procedures and results of the holding company-wide remuneration system in order to determine whether it creates incentives for a good risk management, capital and liquidity management;

- Work closely with the Risk Committee which must also assess whether the incentives generated by the remuneration system take due account of the risk profile of the holding company, its capital and liquidity needs and the forecast of its revenues.

The Human Resources and Compensation Committee met six times during 2022, including on February 7, April 21, May 5, May 31, September 14, and November 11. The average attendance rate of members was 79%.

Continuing education

In parallel to the evaluation, targeted training is organized for all on standards and issues of good governance. In 2018, a training session for the Group’s Directors and managers was held on the impact of the Banking Commission’s circulars on the activities of WAMU banks.

The training schedule for the Group’s directors is one of the topics of the six meetings of the Ethics, Good Governance and Nomination Committee.

Directors were satisfied with their level of training during the Board’s self-assessment in 2022. However, the level of preparation for the Board meetings and its Committees could be still be improved and could one of the topics in future training in the years to ome.

Evaluation of the Management Board

The Board of Directors conducts an annual evaluation of its functioningby introspecting on its performance, the individual and collective contribution of directors, and making the necessary adjustments, and highlighting the training needs.

In 2015, a first self-assessment of directors was conducted by the Ethics and Good Governance Committee. Since 2017, it has been combined with an evaluation led by an external firm. The system of evaluation of our directors also focuses on the issues of Ethics and Compliance.

In 2022, this self-assessment shows that directors have overall the personal skills to properly carry out their mandate. The cognitive and functional qualities of the members of the Board are also satisfactory and sufficient.

Board members completed the online evaluation questionnaires by ranking a list of statements according to the following scale: Yes (Perfectible Very Satisfactory) / No / N/A.

Oragroup S.A.’s Board of Directors’ evaluation for 2022 was conducted in the form of a questionnaire to assess the following areas:

At the Board level

- Core Responsibilities

- Obligations vis-à-vis the executive body Structure and composition Organization and operation

- Specialized Committees

- Deontology, ethics, governance and principles of good conduct

At the level of the Board’s five committees

- Compliance with the charter content Members appointment process

- Conduct of meetings

- Training of members and the resources made available

- Reports to the Board

- Deontology, ethics, governance and principles of good conduct

At the level of Board members

- Personal competence (motivation, integrity, loyalty, independence of mind)

- Cognitive and functional qualities (analytical and synthesis skills, objectivity, open-mindedness, sense of ethics, team spirit, listening and sensitivity, communication, influence, vision, political sense, sense of responsibility, decision-making and solidarity, management sense)

Board Diversity

Mrs. Marie-Ange SARAKA YAO is the only female member of the Board of Directors. The Board of Directors shall ensure that its composition fairly reflects the voting rights of its shareholders and the internationalization of the Group’s activities, including the presence of directors of different nationalities and cultures.

However, the issue of the quota of women on Boards is one of the areas of improvement identified in the Board’s self-assessment in 2022.

Remuneration of governance bodies

The remuneration and benefits of directors shall be determined in accordance with the provisions of the Uniform Act on Commercial Company Law. They are the subject of an initial proposal by the Board of Directors, which submits them to the validation of the Ordinary General Assembly, which determines the overall amount of the functional allowances to be allocated to the members of the Board of Directors

This amount is distributed among all members of the Board of Directors in the amount Y for the President, Y x 80% for independent directors and Y x 50% for other non-executive directors. The payment of official allowances shall be made at the beginning of each quarter. The amounts paid cover committee work.

The directors received a job allowance, the amount of which was determined by the general assemblymeeting and distributed by the Board itself among its members. The amount of the job allowances paid to the directors has been regularly reported to the auditors.

The total amount of salaries, allowances and various allowances, honoraria and benefits in kind paid to the five highest paid people for the financial year ending 31 December 2022 shall be 1,250,243,362 CFA francs.

The total remuneration paid to the five highest paid people amounts to 1,375,839,695 CFA francs.

Annual variable compensation is determined based on the achievement of precise and demanding quantitative and qualitative objectives, aligned with the Group’s strategy and priorities. These targets are set annually by the Board on the recommendation of the Human Resources and Compensation Committee.

The amount of the variable remuneration shall be at the end of the financial year for which it applies. This evaluation shall be carried out, for the quantitative objectives, on the basis of the financial indicators and other figures as ofDecember 31 defined beforehand, and, for the qualitative objectives, also previously defined, on the basis of the concrete financial and extra-financial achievements reached by the Managing Director. The level of achievement of these objectives shall be communicated, criterion by criterion, at the end of the Board of Directors, noting the performance of the Managing Director, without any possible compensation between the criteria.

Delegation of responsibility

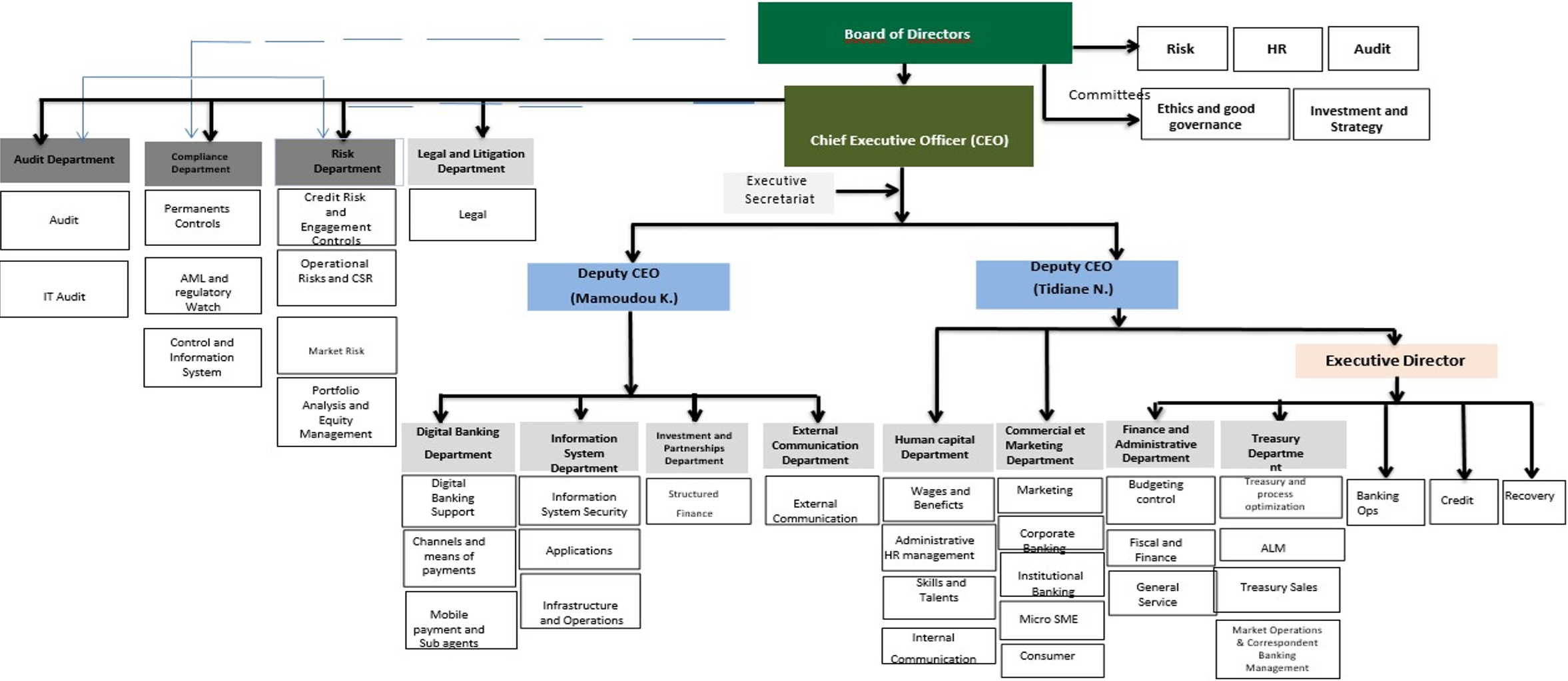

Mr. Ferdinand NGON KEMOUM is the Managing Director, assisted by two Deputy Managing Directors.

The Managing Director and Deputy Managing Directors shall be vested with the most extensive powers to act in all circumstances on behalf of the Company, within the limits of the objects of the company and subject to those expressly assigned to the General Meetings and specially reserved to the Board of Directors by the legal provisions and/or by the statutes. Their mandate does not include any specific limitation of powers vis-à-vis third parties.

The Rules of Procedure contain various provisions designed to promote informed decision-making on important or strategic operations.

As part of an internal analysis of the sustainability and improvement of Orabank’s governance, measures were adopted and implemented:

- Drawing up a charter defining a clear, transparent and effective organization between the holding company and its subsidiaries;

- Formalization of the various Group procedures;

- Strengthening the organization of the holding company by creating and strengthening key functions to support subsidiaries;

- Establishment of management committees;

- Reform of the appropriation approval process by introducing more collegiality in decisions;

- Adaptation of the system of delegation of power;

- Anticipating our compliance with regulators to align with Basel II and III standards by 2017.

Corporate Social Responsibility (CSR) is at the heart of our businesses and our group works towards integrated value creation, not only in terms of our financial performances but also integrating the nature of the resources committed to achieving these results and the impact of these results on our stakeholders and on society in general.

Governance sets targets for societal contribution to Africa and validates annually the integrated report that presents our commitments and results in support of the UN SDGs and based on recognized international frameworks such as GRI standards and PRI principles.

Continuous improvement of risk control

Effectiveness of risk management procedures

ORAGROUP’s internal control and risk management procedures are part of a system in accordance with Circular No. 003/2017 of the Banking Commission on the organization of the system of internal control of WAEMU institutions. The Orabank Group has internal audit, risk management and compliance control functions.

The ORABANK Group has an internal control system that is structured into three levels of control or lines of defense:

- The first level of control is carried out by the operational agents on their work process to ensure the regularity, security, and validation of operations. This level of control is supplemented by validation phases, either between staff (principle of separation of tasks) or by the manager, who ensures the proper functioning of the operational control and makes it possible to ensure that the procedures for processing operations are respected at all levels. These a priori controls are supplemented by a posteriori controls carried out by the manager. These may include random checks aimed at ensuring, on a random but permanent basis, that the procedures and controls are well respected by the employees.

- The second-level control then takes place to verify, at an appropriate frequency, the regularity of transactions, compliance with procedures, and the effectiveness of the first-level controls carried out by the operational units. Second-level supervision covers all the bank’s activities.

- The third-level control reviews the permanent control plan (first and second-level control) within a specific scope to ensure the regularity and conformity of transactions, compliance with procedures, and the effectiveness of previous plans, including their adequacy to the nature of all risks associated with transactions. Through periodic, last-level evaluations, the objective is to ensure, in general, that the internal control framework is in place and functioning as it should.

Reliability of financial reporting lies in the establishment of operational, accounting and internal control procedures to detail the steps involved in recording and the proper accounting of the operations carried out by the organization, in order to produce financial statements, which give a true and fair view of assets, finances and profit or loss in accordance with current accounting principles and rules. The quality of this system of internal accounting and financial control is also reflected in:

- Separation of tasks, which makes it possible to clearly distinguish between registration tasks, operational tasks and preservation tasks;

- A description of the functions to identify the origins of the information produced and its recipients;

- A mechanism to ensure that transactions are carried out in accordance with general and specific instructions and are accounted for in a manner that produces financial information consistent with generally applicable accounting principles.

Each of the supervisory functions is placed under the authority of a director and reports hierarchically to the Managing Director and functionally to the Board, which is responsible for their selection, supervision of their performance and their dismissal.

Each of the control functions shall:

- Has competent and quantitative human resources to carry out its mission;

- Maintains the knowledge acquired and provides continuous and up-to-date training for each staff member assigned to it;

- Is independent and permanent;

- Has sufficient reputation and authority to ensure that officials carry out their duties;

- Detects and manages apparent and potential conflicts of interest;

- Provides governance bodies with accurate, up-to-date and intelligible information to enable them to make wise decisions.

The risk management function oversees the risks taken on all Orabank Group activities. The governance framework for the risk management function within the Orabank Group ensures effective participation of the Board of Directors and the executive through oversight of the functions and the existence of a real risk management environment. The organizational structure of the Orabank Group Risk Management is organized around three main pillars: Governance, Management and Control.

This structure allows:

- Supervision by the Board of Directors and the Executive Body;

- The existence of independent risk management functions ensuring separation; between operational units and control functions;

- The existence of independent control units.

Orabank is committed to continuously improving its system for identifying, assessing, monitoring, controlling and managing the risks linked to its activities. Since 2015, our growth model has undergone a major transformation and the Orabank Group integrates the management standards of international banks. One of our core missions is to maintain a strong risk management system that continuously supports the growth of Orabank Group.

This allows the supervision and management of all risks taken on the activities of entities such as credit risks, operational risks, market risks, strategic risk, social and environmental risks. The Environmental and Social Risk Management System (SYMRES), set up by the Orabank Group, is used in the provision of financing and aims to identify potential social, environmental and governance risks related to any investment project submitted to the bank.